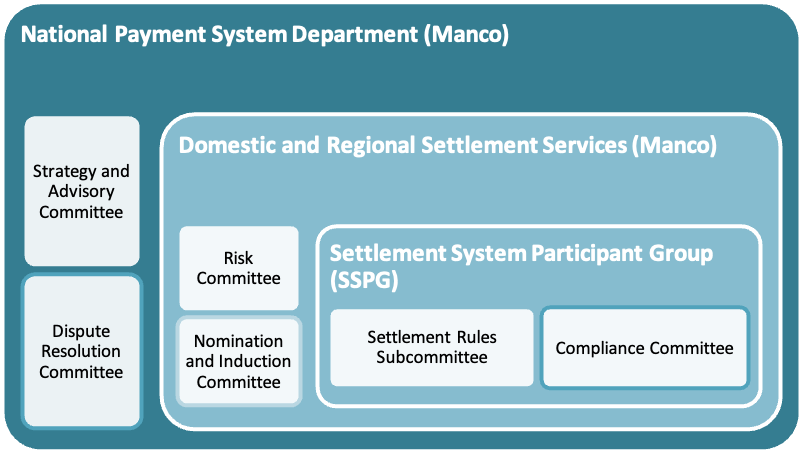

Governance Structures

| Committees | Mandate |

| Settlement System Participant Group (SSPG) | •Writing of Rules of Participation in SAMOS |

| •Implementing Settlement Rules and Compensation Rules | |

| •Overall enforcement of compliance with Rules | |

| •Managing Settlement Agreement | |

| Nomination and Induction Committee | •Identifying, evaluating, and recommending candidates for appointment and designing, planning, and implementing an induction program. |

| •Induction and ongoing training of members of committees; | |

| •Ensuring that members and chairpersons has the necessary skill to act as member of a specific committee | |

| •The process on how members of respective committees are nominated and appointed (process to be documented and annexed to Rules and Scheme Policy) | |

| •Reviewing the composition of the committee members on a regular basis to ensure that it maintains the appropriate mix of seniority, skills and experience required; | |

| •Ensuring that the members are not conflicted in terms of their participation on other boards or committees. | |

| Settlement Rules Subcommittee | •Performing assessments in line with the latest version of the approved rules; |

| •Consider recommendations received to amend a rule and/or introduce a new rules; | |

| •Identify operational items related to the settlement processes associated with all payments, evaluate their potential impact, and provide the SSPG with recommendations for decision; | |

| •Continuously monitor settlement trends for all payment systems, to identify any inconsistencies to recommend the required rule changes; and | |

| •Discuss and recommend to the SSPG, rules and procedures, to improve the landscape and/or mitigate risks and issues. | |

| Risk Committee | •Perform formal risk assessments in line with defined framework, policy and process; |

| •Identify operational and strategic risks associated with payments, evaluate their potential impact, and recommend risk mitigation measures, for decision making by the respective SSPG; | |

| •Monitor the payments fraud landscape and identify mitigation measures for escalation to the SSPG; | |

| •Assess current control measures and monitor the implementation of mitigation action plans; | |

| •Provide input into the identification and selection risk tolerance levels; | |

| •Monitor that the risks are managed within the defined tolerance and appetite limits and escalate areas of concern to the SSPG. | |

| •Discuss and recommend risk management and control improvement measures, for incorporation in strategic initiatives; | |

| •Provide input into the identification and selection of Key Risk Indicators (KRIs) and ensure ongoing monitoring and reporting or KRI statistics. | |

| Strategy and Advisory Committee | •Competition matters |

| •Standards in respect of payment systems within NPSD | |

| Compliance Committee | •Reviewing actions resulting in alleged non-compliance. |

| •Considering RSM’s report on non-compliance; | |

| •Reviewing all written and oral representations from participants; | |

| •Evaluating all relevant documentation and information; | |

| •The CC shall determine the merits of each case; | |

| •Before imposing sanctions, the CC will assess mitigating and aggravating factors; | |

| •Enforce compliance to rules by imposing sanctions. | |

| Dispute Resolution Committee | •Handling of appeals by participants on findings/sanctions by the Compliance Committee; |

| •Upholding or overturning a finding of the Compliance Committee; and/or | |

| •Imposing a new sanction, where necessary. |

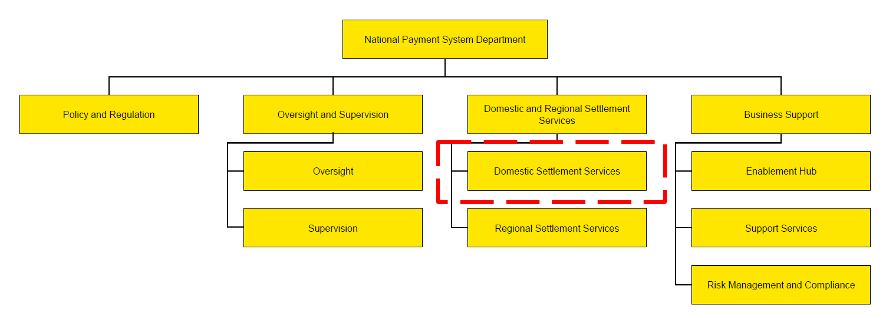

The Domestic Settlement Rules Management Unit DSRMU

The DSRMU is structured around a steering committee and supporting sub-groups. At the top is a convening council (the settlement participant group), which reports to the recognized payment authority. Beneath it, the unit is served by an executive office and by several specialized subcommittees. For example, one subcommittee is dedicated to rules for high-value securities, another to margin requirements for derivatives, and so on . In addition, regulatory support forums – such as compliance, legal and dispute-resolution committees – oversee our processes to ensure they meet the NPS legal requirements . This governance hierarchy (council → executive office → stakeholder forums → PCH participant groups) provides clear accountability and ensures that rule-making is both comprehensive and coordinated.