SARB – Domestic Settlement Rules Management

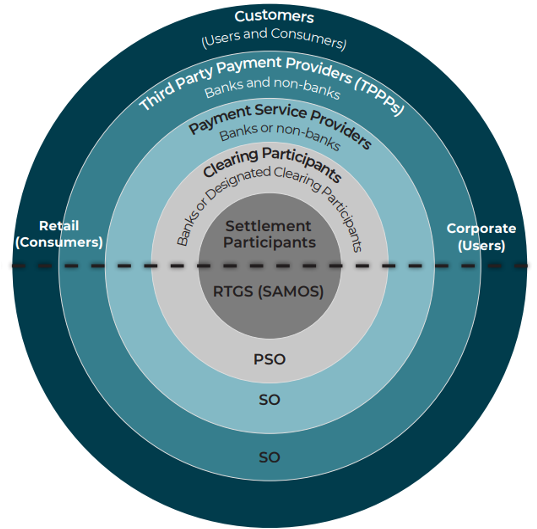

The Domestic Settlement Rules Management unit at SARB oversees the rules and frameworks governing the clearing and final settlement of financial transactions in South Africa. Our mandate is legally grounded in the National Payment System Act, 1998, and is key to ensuring trust, efficiency, and finality in the country's payment systems.

Our Mandate

We define and enforce the Domestic Settlement Rulebook, manage participant registration, oversee real-time settlement operations, and align with global standards such as ISO 20022.

Strategic Value

Our work enhances financial system stability, supports innovation in payments, and ensures all domestic transactions are settled securely and irrevocably.

Key Functions

- Rulebook Management: Maintain official clearing and settlement protocols.

- Participant Oversight: Register and supervise eligible financial institutions.

- System Integrity: Manage SAMOS operations and ensure finality of settlement.

- Risk Governance: Implement controls to mitigate operational and systemic risks.

- Public Transparency: Provide open access to rulebooks, guidance, and regulatory updates.

Contact & Participation

To access the Domestic Settlement Rulebook, become a recognized participant, or request additional information, contact:

Email: ?????????

Website: www.resbank.co.za